Self Assessment customers should be alert to criminals claiming to be from HM Revenue and Customs (HMRC).

As the department issues thousands of SMS messages and emails as part of its annual Self Assessment tax return push, HMRC is warning customers completing their returns to take care to avoid being caught out by scammers. The annual tax return deadline is on 31 January 2021.

The department knows that fraudsters use calls, emails or texts to contact customers. In the last 12 months, HMRC has responded to more than 846,000 referrals of suspicious HMRC contact from the public, and reported over 15,500 malicious web pages to internet service providers to be taken down. Almost 500,000 of the referrals from the public offered bogus tax rebates.

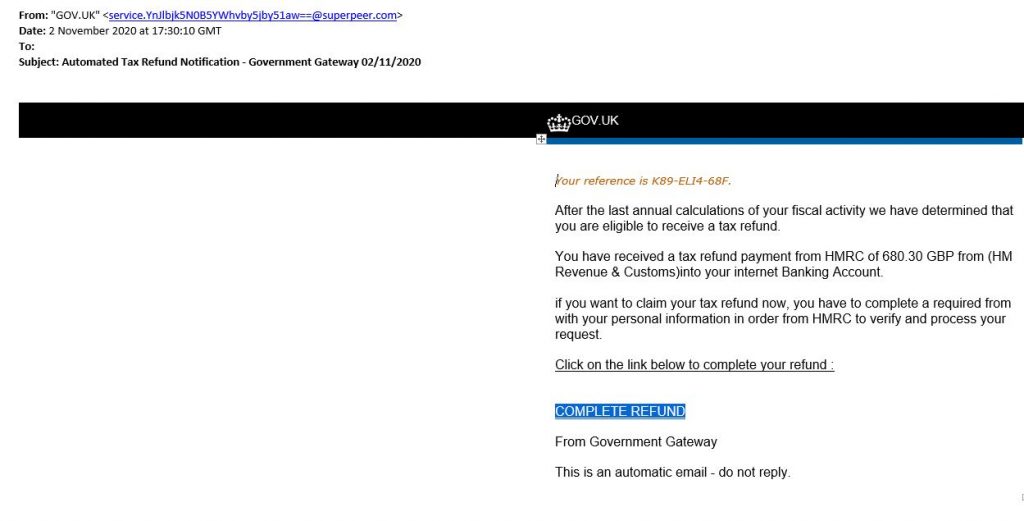

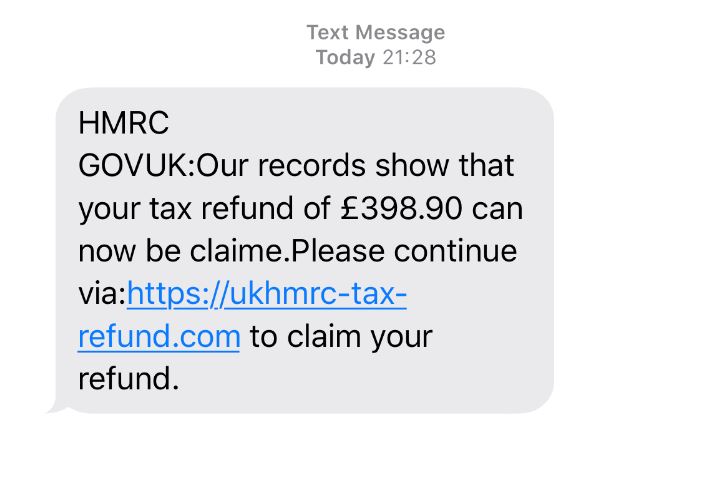

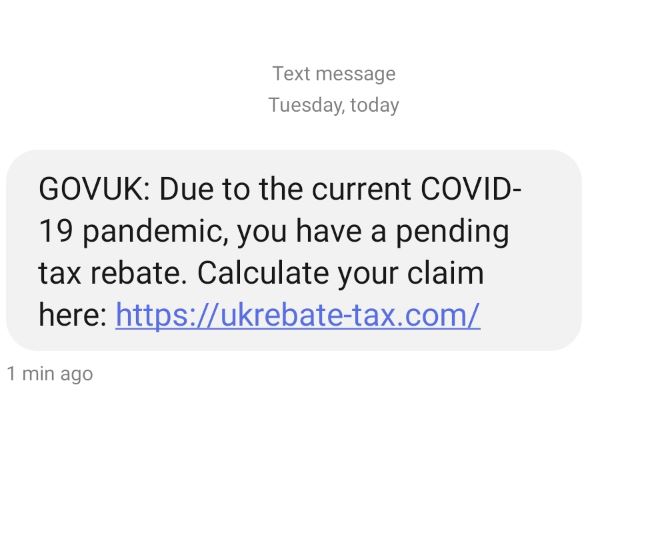

Many scams target customers to inform them of a fake ‘tax rebate’ or ‘tax refund’ they are due. The imposters use language intended to convince them to hand over personal information, including bank details, in order to claim the ‘refund’. Criminals will use this information to access customers’ bank accounts, trick them into paying fictitious tax bills, or sell on their personal information to other criminals.

HMRC’s Interim Director General for Customer Services, Karl Khan, said:

“We know that criminals take advantage of the Self Assessment deadline to panic customers into sharing their personal or financial details and even paying bogus ‘tax due’.

“If someone calls, emails or texts claiming to be from HMRC, offering financial help or asking for money, it might be a scam. Please take a moment to think before parting with any private information or money.”

Pauline Smith, Head of Action Fraud, said:

“Criminals

are experts at impersonating organisations that we know and trust. We work

closely with HMRC to raise awareness of current scams and encourage people to

report any suspicious calls or messages they receive, even if they haven’t

acted on them, to the relevant channels. This information is crucial in

disrupting criminal activity and is already helping HMRC take down fraudulent

websites being used to facilitate fraud.

“It’s important to remember if you’re contacted out the blue by someone

purporting to be from HMRC asking for your personal or financial details, or

offering you a tax rebate, grant or refund, this could be a scam. Do not

respond, hang up the phone, and take care not to click on any links in

unexpected emails or text messages. You should contact HMRC directly using a

phone number you’ve used before to check if the communication you have received

is genuine.

“If you’ve been the victim of fraud, contact your bank immediately and please report it to Action Fraud online at actionfraud.police.uk or by calling 0300 123 2040.”

Customers can report suspicious activity to HMRC at phishing@hmrc.gov.uk and texts to 60599. They can also report phone scams online on GOV.UK.

HMRC is also warning the public to be aware of websites that charge for government services – such as call connection sites – that are in fact free or charged at local call rates. Other companies charge people for help getting ‘tax refunds’. One way to safely claim a tax refund for free is to log into your Personal Tax Account.

HMRC has a dedicated Customer Protection team that identifies and closes down scams but asks the public to recognise the signs to avoid becoming a victim. HMRC regularly publishes examples of new scams on GOV.UK to help customers recognise phishing emails and bogus contact by email, text or phone.

Ways to spot a tax scam

It could be a scam if it:

- is unexpected

- offers a refund, tax rebate or grant

- asks for personal information like bank details

- is threatening

- tells you to transfer money.

Self Assessment customers can complete their tax return online and help and support is available on GOV.UK.

To protect against identity fraud customers must verify their identity when accessing HMRC’s online services. They must have two sources of information including:

- credit reference agency data

- tax credits

- P60/payslip

- UK Passport